Tennessee Beef Promotion Program

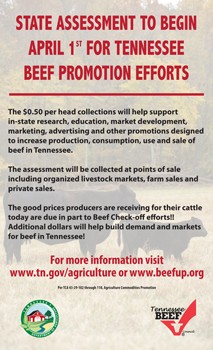

Tennessee Beef Promotion Program assessments began April 1, 2012. Tennessee cattle producers voted in favor of the measure to support in-state research, education and promotion of beef.

The referendum was requested by the Tennessee Cattlemen’s Association, the state’s largest cattle organization. The program collects a 50-cent assessment on each head of cattle sold in Tennessee. The funds are overseen by the Tennessee Beef Promotion Board which consists of representatives from the Tennessee Livestock Market Association, Tennessee Cattlemen’s Association, Tennessee Farm Bureau Federation, Tennessee Dairy Association, and Tennessee Beef Cattle Improvement Initiative which represents Tennessee purebred producers.

- A 50-cent assessment should be made on each head of cattle sold in Tennessee whether it is sold through a livestock market or private sale.

- There will be one form used for all parties remitting funds to the Tennessee Beef Promotion Board

- Download a copy of the Remittance Form.

- Remittance checks should be made payable to the Tennessee Beef Promotion and be mailed to:

Tennessee Beef Promotion

P.O. Box 305133

Nashville, TN 37230-9947 - Assessments are to be made to the Tennessee Beef Promotion Board no later than 10 days after the end of each calendar month. Example: If a sale is held on March 12, funds should be remitted to the Board no later than April 10.

- If monthly payments are received after the 10th of the month following the sale, a 10% penalty shall be imposed.

- Per TCA 43-29-110, each purchaser shall keep a complete and accurate record of cattle handled and furnish each producer with a signed sales slip showing the amount of cattle purchased and the amount deducted by the purchaser for the promotion fund. These records shall be kept for two (2) years and shall be open to inspection at any time and without notice by the commissioner or the commissioner’s representative.

- Per TCA 43-29-109, the assessment levied on each head of cattle sold shall not apply to cattle purchased by a purchaser whose only share in the proceeds of a sale is a sales commission or handling fee or other service fee and who has delivered the cattle to facilitate the transfer of ownership from the seller and a third party

- These cattle must be resold within ten (10) days from the date on which the person acquired ownership, with certification made to the department of agriculture on forms approved by the commissioner.

- Non Producer Status Forms can be obtained by contacting:

Kaylea King

(615) 896-5811 or kking@tnbeef.org

- Per TCA 43-29-111, within ninety (90) days of an assessment being withheld by the purchaser, any producer may make application to the commissioner on the forms to be prescribed by the commissioner for refund of assessments withheld. The application shall be accompanied by copies of sales slips evidencing the withheld assessment for which the refund is sought.

- Refund forms can be obtained by contacting:

Kaylea King

(615) 896-5811 or kking@tnbeef.org - Forms will be mailed directly to producers requesting refund. Original forms must be submitted.

- Producers requesting a refund should submit the Original Refund Form and copy of sales slip showing where assessment was withheld to:

Tennessee Beef Promotion – Refund

530A Brandies Circle

Murfreesboro, TN 37128 - Producers can submit a Refund Form for multiple sales as long as the form is submitted within 90 days of the earliest sale listed. If a sale listed is prior to the 90 days allowed for a refund request, a refund will be paid for the sales within the 90 days.

For More Information

Business Development

615-837-5160

Business.Development@tn.gov

Tennessee Beef Promotion Board

P.O. Box 305133

Nashville, TN 37230-9947

Point of Contact for Assessments and Refunds:

Kaylea King

(615) 896-5811 or kking@tnbeef.org